Introduction

Investing can be tricky, but new tools powered by artificial intelligence (AI) are changing the game. These smart tools are gaining popularity, especially with people who are new to investing. The exciting part? These AI tools are even giving top-rated market standards, like the S&P 500, a run for their money.

One such tool is Danelfin, perfect for beginners. It’s easy to use and helps make investing a breeze. The best part is that studies have shown Danelfin can lead to better returns on your investment than traditional market standards, like the S&P 500, thanks to its smart technology.

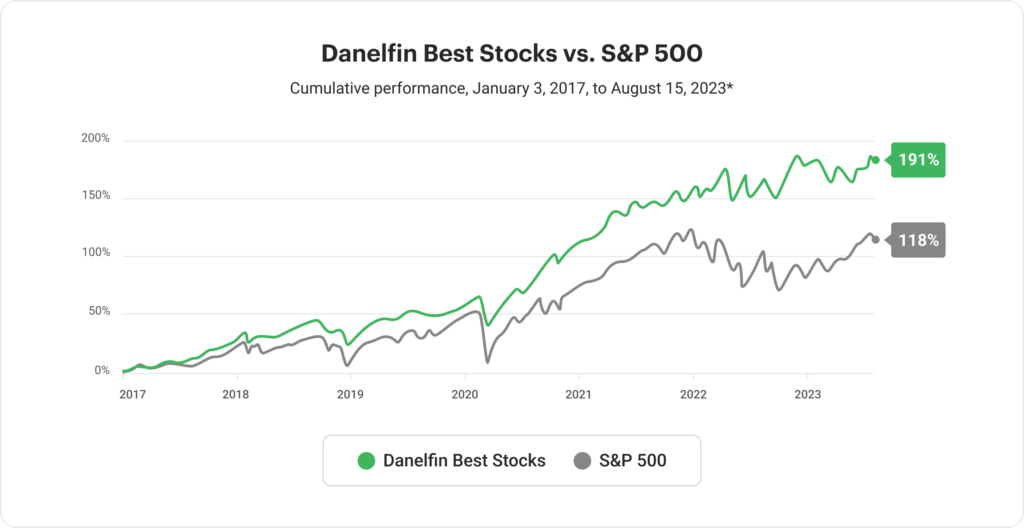

The Danelfin Best Stocks strategy, driven by AI, achieved a remarkable return of +191% between January 3, 2017, and August 15, 2023. In contrast, the S&P 500 saw a comparatively lower performance, with just a +118% return during the same timeframe.

The S&P 500 is a big deal in investing. It’s a way to judge how well the market is doing. If you can do better than the S&P 500, that’s a big win. That’s why what Danelfin is doing is so impressive!

Why Use AI Stock Analytics?

First of all, you need to understand the importance of data in making investment decisions. It is as important as oxygen for staying alive. Without it, you’re just blindly throwing your money into a wishing well and hoping for the best.

With the continuous evolution of stock markets, sticking to outdated strategies could lead to falling behind and missing out on potential gains. It is crucial to adapt to the new dynamics of the market to stay ahead. Failing to adapt to the changing landscape of investment analysis can result in significant setbacks. Here’s why it’s crucial to stay updated:

– Identifying New Opportunities: Changing markets bring forth new investment opportunities that can yield substantial returns. Adapting to emerging trends can help identify and capitalize on these opportunities.

– Managing Risk Effectively: By understanding the evolving dynamics of markets, investors can develop strategies to manage risk more effectively, minimizing losses during uncertain times.

– Gaining a Competitive Edge: Staying ahead of the curve gives investors a competitive advantage and increases the chances of achieving financial goals.

So why settle for mediocrity when you could have exceptional results instead?

Understanding AI in Investing

AI helps make investing easier. It quickly checks tons of information, predicts market trends, and helps manage risks. This is super helpful for beginners, as it takes care of the hard stuff, making investing less intimidating.

The Traditional Investment Landscape

Traditionally, investing has always been a game of patience and precision. Investors relied on fundamental analysis, technical analysis, or a blend of both to make investment decisions. However, these methods, while often effective, require a significant time investment and financial acumen, creating barriers for newcomers.

Emergence of AI in Investing

With the advent of AI, a paradigm shift is underway. AI interprets massive volumes of data at speeds no human can match, identifying potential investment opportunities with high accuracy. This technological advancement has democratized investing, making it more accessible to beginners and reducing dependency on financial gurus.

What Makes AI Superior?

AI operates on a level of complexity and efficiency that’s unparalleled. It isn’t swayed by emotions, and it can analyze patterns across numerous markets simultaneously. This unbiased, multi-dimensional approach gives AI an inherent advantage in predicting market fluctuations.

How Does Danelfin Work?

Danelfin is an advanced stock analytics platform utilizing Explainable Artificial Intelligence (AI) to rate stocks and ETFs. Here’s a summary of how it works:

- AI Score: Danelfin assigns a global AI Score to stocks and ETFs, ranging from 1 to 10, indicating the likelihood of outperforming the market over the next three months. A higher score suggests a higher probability of success.

- Performance: The platform’s AI-driven strategy, “Danelfin Best Stocks,” has demonstrated significant returns, outperforming standard benchmarks like the S&P 500.

- Coverage: It analyzes a wide range of stocks, including all US stocks, STOXX Europe 600 stocks, and US-listed ETFs, transforming complex indicators into user-friendly scores.

- Technology: The AI analyzes over 10,000 features per stock/ETF daily, considering technical, fundamental, and sentiment indicators. It learns from market trends and uses this data in predictive models.

- Trade Ideas: Danelfin highlights potential trades with historical success, providing insights into buy/sell signals based on past performance.

- Transparency: The platform operates on Explainable AI, meaning it provides clear insights into how scores are calculated, avoiding the “black box” approach.

- Portfolio Management: Users can build and monitor portfolios, track AI Scores of their investments, and receive alerts on score changes to make informed decisions.

- Score Explanation: For transparency, users can see which indicators were most influential in determining a stock or ETF’s score.

By integrating these elements, Danelfin provides a comprehensive tool for investors to assess potential investments, backed by a substantial data-driven approach.

For more detailed information, you can view their full explanation on their official website: Danelfin How It Works.

The Future of AI in Investing

AI’s role in investing is only expected to grow. We anticipate further integration of AI into traditional investing strategies, making them more efficient, and a shift towards ethical investing as AI uncovers the impacts of investments on society and the environment.

Integration of AI in Traditional Investing

The future likely holds a hybrid approach, where traditional methods are enhanced with AI’s analytical capabilities. This integration will help investors make more informed decisions, backed by a wealth of data insights.

Ethical Investing and Sustainability

AI is set to play a significant role in ethical investing. By analyzing the societal and environmental implications of investments, AI can help investors choose companies that prioritize sustainability, promoting a more socially responsible form of capitalism.

Conclusion

Smart investing tools, like Danelfin, are making it easier to start investing. They’re user-friendly and can help people do really well in the stock market. It’s important to be careful and make balanced choices, but these tools are a big step forward in making investing something anyone can do.

FAQ

- What is Danelfin? Danelfin is an AI-powered tool that helps beginners with investing. It’s designed to make investment decisions easier and more profitable.

- How does AI help in investing? AI can process a lot of data very fast, make predictions, and manage risks. It takes care of the complex parts of investing, which can be really helpful for beginners.

- Why is beating the S&P 500 a big deal? The S&P 500 shows the performance of the market as a whole. Doing better than the S&P 500 means you’re beating the market average and your investments are doing really well.

- Can I rely solely on Danelfin for investing? Danelfin is a powerful tool, but it’s still important to be aware of risks. Unexpected things can affect the market. It’s smart to have a variety of investments and not rely only on one tool.

- Is AI going to change the future of investing? Yes, it looks like it! AI is making investing simpler and more accessible. It’s helping create a future where everyone has the power to invest wisely.

- Is AI investing safe for beginners? Yes, AI investing is designed to be user-friendly, and platforms often have built-in risk management protocols to protect investors.

- Can AI-driven portfolios outperform experienced human investors? In many cases, yes. AI’s emotion-free, data-driven decisions can lead to more consistent returns, even outperforming seasoned investors.

- Do I still need a financial advisor if I use AI for investing? It depends on your financial goals and complexity. While AI can handle investing, some individuals may benefit from a human advisor’s comprehensive planning.

- How does AI investing contribute to responsible investing? AI can analyze extensive data on corporate practices, helping investors make decisions that align with their ethical values regarding environmental and social impacts.

- Will AI completely replace human roles in investing? Not completely. AI is a tool that enhances investing strategies. Human insight and relationship management remain crucial aspects of the investment process.